May 29, 2011

Memorial Day

On this Memorial Day please thank a Veteran and remember our ancestors who sacrificed so much in order for us to be free and life in the most open society on earth.

Memorial Day

Was trying to come up with a good Memorial Day post. Then rememebered the one I posted last year from ambulancedriverfiles.com and realized there was no way I could improve on it. So here it is again. If you didn’t read it last year, read it this year; if you did read it last year, read it again.

Memorial day...

Most of us will spend the weekend grilling burgers and visiting with relatives, or lounging on a beach somewhere, or watching a baseball game in an opulent stadium, overpriced beer and hot dog in hand. And most of us will have forgotten the meaning of the day.

So when you partake in your Memorial Day festivities this weekend, try to remember a few things.

When the smoke from the grill blows into your eyes, try to imagine the terror of the young pilot as the smoke fills the cockpit of his F4 Wildcat, spiraling into the sea off Guadalcanal.

When you sample those pork ribs, remember the Iowa farm boy whose life blood stained the surf at Normandy.

When you eat a bite of potato salad, think of an Idaho preacher’s kid who died with a prayer on his lips, asking God to forgive him for the enemy soldiers’ lives he had taken.

While you enjoy the warm summer sun on your face, take a moment to think of the frozen bodies of American soldiers strapped to jeeps and tanks at the Chosin Reservoir.

When you welcome your niece’s new boyfriend to the table, remember the black kid from Mississippi who died right beside his white buddies in Vietnam, though he wasn’t even allowed to eat in the same restaurants back home.

When you scold your misbehaving grandchild, think of the little boy whose only knowledge of his father will come from stories told by family, because Daddy died on a dusty street in Fallujah while he was still in the womb.

When you fetch your wife another glass of tea, think of a young wife living in base housing at Fort Benning, as she hears the news that her husband died at Ia Drang.

When you invite Grandpa to say grace before the meal, think of young men cut down by a hail of fire from a Maxim at Belleau Wood.

When you reflect with pride on your daughter’s recent graduation, think of a young woman cartwheeling into the sea in her F14 Tomcat after a failed carrier landing.

When you look with distaste at the tattoos on her new boyfriend, think instead of the former gang kid from Detroit who found a way up and out of poverty in the Army, only to die from an IED blast in Baghdad. And remind yourself that what matters is how he treats your daughter, not the ink on his arms.

Whilst you enjoy your beer and bratwurst, remember the 19 -year-old Army private who died in a training accident in Grafenwohr in 1960, one of many young men who knew they’d be little more than a speed bump should the Russians ever come pouring through the Fulda Gap. Yet still, they served.

When you sit at the table, think of a Navy Captain, a husband and father, who died at his Pentagon desk on September 11. His death was no less honorable.

If you’re traveling today, think of the passengers of United Flight 93, for in a field outside Shanksville they became the first soldiers in our war on terror.

When your boys fight, as boys will do, remember the boys on both sides who died at Gettysburg.

If a loved one can’t make it to the gathering today, think of Mrs. Bixby and her five sons.

While your kids play in the pool this afternoon, think of other kids not much older, trapped below decks as the Arizona went under at Pearl Harbor.

If you have bemoaned the layoffs of friends and co-workers in the recent economic crisis, think of the Navy SEAL who lost every single one of his teammates on a rainy night in Kunar Province, Afghanistan.

When you take a shower tonight, think of young men reeking of machine oil and sweat, desperately trying, and failing, to surface their wounded submarine somewhere in the Pacific in 1943.

**********

I tell you of these things not to spoil your appetite or your day, but to remind you that the things we enjoy in our lives are made all the sweeter when you consider what made them possible.

Remind yourself also that your sacrifice is infinitely easier. All you need do is sacrifice a moment of your time every few years to pull a lever. The way to honor a dead soldier is not simply to fly a flag on Memorial Day. Vote to preserve the freedoms they died defending. Elect leaders worthy of those rough young men and women who stand ready to do violence on your behalf.

And stop by your local Veteran’s Cemetery and put out some flowers on the grave of your choice. It need not even be the grave of someone you know.

Bring your children along, and explain to them why. It’s important.

-Kook via ambulancedriverfiles.com

May 20, 2011

Nixa MO Family Could Face Millions in Fines from USDA for selling Rabbits without a license

Here are the salient facts of this total over reaction by the Federal Government, specifically the USDA APHIS unit.

The backstory:

“About six years ago, the Dollarhites wanted to teach their young teenage son responsibility and the value of the dollar. So they rescued a pair of rabbits — one male and one female — and those rabbits did what rabbits do; they reproduced. Before long, things were literally hopping on the three-acre homestead 30 miles south of Springfield, and Dollarvalue Rabbitry was launched as more of a hobby than a business.

“We’d sell ‘em for 10 or 15 dollars a piece,” John said during a phone interview Tuesday afternoon, comparing the venture to a kid running a lemonade stand. In addition, they set up a web site and posted a “Rabbits for Sale” sign in their front yard. Most customers, however, came via word of mouth.

In the early stages, some of the bunnies were raised and sold for their meat. Much further down the road, John said, they determined it more profitable to sell live bunnies at four weeks old than to feed bunnies for 12 weeks and then sell them as meat.

“We started becoming the go-to people” for rabbits in the Springfield area, John said. “If you wanted a rabbit, you’d go to Dollarvalue Rabbitry.” He added that the family even made the local television news just before Easter in 2008 for a report about the care and feeding of “Easter bunnies.”

…During the summer of 2009, the Dollarhites bought the rabbitry from their son who had grown tired of managing it. They paid him what he asked for it, $200. Things kept growing, however, and the Dollarhite’s landed a pair of big accounts in 2009.

A well-known Branson theme park, Silver Dollar City, asked the Dollarhites to have them provide four-week-old bunnies per week to their petting zoo May through September. When the bunnies turned six weeks old, they were sold to park visitors. The Springfield location of a national pet store chain, Petland, purchased rabbits from the Dollarhites as well.

…By the year’s end, the Dollarhites had moved approximately 440 rabbits and grossed about $4,600 for a profit of approximately $200 — enough, John said, to provide the family “pocket money” to do things such as eat out at Red Lobster once in a while. That was better than the loss they experienced in 2008.

Then some unexpected matters began demanding their attention.

It’s an understatement to describe the Dollarhites as being “beyond surprised” when, in the fall of 2009, a female inspector from the U.S. Department of Agriculture showed up at the front door of the family home, wanting to do a “spot inspection” of their rabbitry. She said she had come across Dollarhite Rabbitry invoices while inspecting the petting zoo at Silver Dollar City.

“She did not tell us that we were in violation of any laws, rules, anything whatsoever,” John said, explaining that the inspector said she just wanted to see what type of operation they had. Having nothing to hide or any reason to fear they were doing anything wrong, the Dollarhites allowed the inspection to proceed.

John said he had to go to work at the family’s computer store, so Judy took the inspector to the back of their property where the rabbits were raised. There, the inspector began running the width of her finger across the cage and told the Dollarhites they would need to replace the cage, because it was a quarter-inch too small and, therefore, did not meet federal regulations.

Such a requirement came as a shock to the Dollarhites, because they had just invested in new cages to ensure the bunnies had a healthy amount of space to develop, John explained. Though raising dwarf breed varieties of rabbits which require less space, they had opted to purchase cages designed for “large breed rabbits” so the dwarfs would have plenty of room. All for naught.

Not only was the cage too small, according to the inspector, but she noted a small rust spot on a feeder and cited it as being out of compliance. When the Dollarhites told the inspector that rabbit urine causes the cages to rust and that they worked hard to keep the rabbits cages in top shape, she told them it didn’t matter. The rust spot would count as an infraction.

…During the course of the spot inspection, John said, the inspector asked his wife if she and John would like to have their operation certified by USDA. Judy said she wasn’t sure and asked what certification would entail and if it would help them sell more rabbits. The inspector responded, telling her it would involve monthly inspections and was completely voluntary. The inspection ended with the inspector telling Judy that the Dollarhites rabbits looked healthy and well-cared for.

After the inspection, the Dollarhites didn’t hear from the USDA again until January 2010, John said, when he received a phone call from a Kansas City-based investigator from the USDA’s Animal and Plant Health Inspection Service.

“He called us and said, ‘I need to have a meeting with you and your wife,’” John recalled.

After explaining that he asked the investigator to come after the workday at the computer store had ended, John said he asked the investigator about the purpose of the meeting,

“He said, ‘Well, it’s because you’re selling rabbits and you’ve exceeded more than $500 dollars in a year,’” John said, “and I went, ‘Okay, what does that have to do with anything?’”

John said the investigator refused to discuss details over the phone and made it clear that rejecting his request for a meeting would be a costly error in judgment.

When Judy asked if they should have an attorney present, the investigator responded, saying, “Well, that might be a good thing.”

“At that point, we kind of set back, (wondering) what in the world is going on,” John said. Then he found an attorney who is also a farmer.

…a couple of days later — at the same time both met the APHIS investigator in person at John’s home.

“The first thing (the investigator) said was ‘My name is so and so, I’ve been in the USDA for 30-plus years, and I’ve never lost a case,’” John recalled, continuing. “He said, ‘I’m not here to debate the law, interpret the law or discuss the law, I’m here just to do an investigation.’”

John said the investigator went on to explain that he would ask questions, write a report based on the answers and send that report to his superiors at the USDA regional office in Colorado Springs, Colo. The entire process was suppose to take about a month, and John was told to contact the regional office if he had not heard anything in six weeks.

“At this point in time, we were still not knowing anything about the law he was talking about,” John explained, adding that his rabbitry had never had any issues with any animal welfare agencies.

Eight weeks passed, and John decided to call Colorado Springs. Immediately, he was given the number to a USDA office in the nation’s capitol. He called the new number, and the lady he reached there was blunt, John said.

“She said, ‘Well, Mr. Dollarhite, I’ve got the report on my desk, and I’m just gonna tell you that, once I review it, it’s our intent to prosecute you to the maximum that we can’ and that ‘we will make an example out of you.”

When John once again tried to determine which law he and his wife had violated, he said the USDA lady replied, “We’ll forward you everything.”

“Ma’am, what law have we broken?,” John said. “Well, you sold more than $500 worth of rabbits in one calendar year,” she replied, according to John.

Okay, what does that have to do with anything?” John countered.

The lady replied by saying there is a guideline which prohibits anyone from selling more than $500 worth of rabbits per year, John recalled, but she refused to cite any specific law and, instead, promised to send him the report containing details.

…

Soon after the meeting with the APHIS investigator and with the stress of the investigation hanging over their heads, John said he and his wife traded everything associated with the rabbit operation for other agricultural equipment.

Recently, the Dollarhites received a “Certified Mail Return Receipt” letter (dated April 19, 2011) from the USDA informing them that they had broken the law and must pay USDA a fine of $90,643. Their crime? Violating violating 9 C.F.R. § 2.1 (a) (1) [which is basically selling pets without a license]

Based on an average price per rabbit sold being $10.45, the fine comes out to more than $206 per rabbit. In addition, the letter contains the following statement:

”APHIS laws and regulations provide for administrative and criminal penalties to enforce these regulatory requirements, including civil penalties of up to $10,000 for each of the violations documented in our investigation.”

If the threat contained in the letter is to be believed, the family could be fined as much as $10,000 per rabbit beyond the first 50 bunnies that netted the family its first $500. Do the math (390 rabbits x $10,000 each) and, if they don’t pay the initial fine, they could face additional fines totaling $3.9 million.

Needless to say, the Dollarhites stopped selling rabbits in January 2010 and are considering setting up a legal defense fund.

Dave Sacks, a spokesman for the agency’s subordinate Animal and Plant Health Inspection Service located in Maryland had this to say:

"Our main focus here at USDA’s Animal Care program is to ensure that the animals covered under the federal Animal Welfare Act are being treated humanely. Animal welfare is at the heart of everything we do. So, we consider it very serious when there is an activity regulated under the Animal Welfare Act that is being conducted without a USDA license. Reason being, when individuals are licensed, USDA inspectors conduct periodic unannounced inspections of those individuals’ animals and facilities. It is during these inspections that our inspectors can see how the animals are being treated and handled. When unlicensed individuals conduct regulated activities, this hampers our ability to enforce the Animal Welfare Act and hampers our ability to ensure the welfare of their animals. If you don’t have a license, that means that we are not inspecting your facility and your animals, so we would have no idea how your animals are being treated."

Sacks closed his message to me with the following:

"USDA certainly realizes that $90,000 is a lot of money. But we’ve been called upon by Congress to enforce the Animal Welfare Act so that regulated animals are humanely cared for and treated. And the reality is that there is no way we can guarantee that this care is being provided to these animals unless all individuals conducting regulated activities are licensed."I did a little quick research on the regulation in question and because the Dollarhites were selling the rabbits for pets and not as food and because they sold over the $500 amount and because they were not selling them directly to individuals...they are in violation. It is stupid but it is true. There are so many regulations on the books that it would make the average person's head explode, but it is the way it is, this is how most of our "Laws" are now made.

The USDA is going way overboard on this and needs to be put back on their chain. This story needs told because from the information I have read it seems the USDA is not dealing in good faith and it seems the punishment far outweighs the "crime". Our Government is running rampant.

May 13, 2011

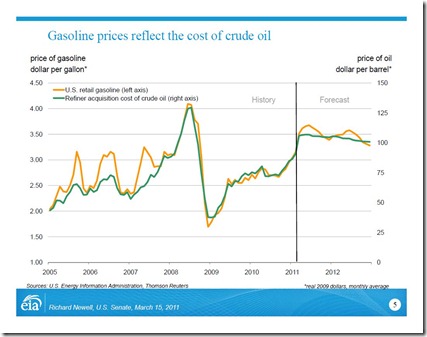

Who Sets Gas Prices At The Pump?

Right now gas prices are hovering around the $3.80 mark in my area of the country. We have all heard rumors of the so far mythical $5 a gallon gas in the US. This is obviously a source of much angst in the US because we are a large country with a large suburban and rural population who have literally grown up as a nation with the automobile. What is more we like BIG automobiles because we spend a lot of time. We like big automobiles because we have active lifestyles, and we use them to work, and we like to feel safe.

So who is to blame? Is it those filthy Oil Executives? OPEC? The owner of the convenience store chain? The government? Yes. it is all of those folks. But it is way more complicated than that and unfortunately even after a lot of study the answers are not that satisfying. What is more it is so complicated that there is no easy answer.

To even begin to understand this issue you have to start at the beginning. It is the most basic Economic rule. Supply and Demand. On the Supply side is a group of countries, primarily known as OPEC, Oil Producing and Exporting Countries.

OPEC is a consortium of 13 countries: Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela.Together, these 13 nations are responsible for 40 percent of the world's oil production and hold the majority of the world's oil reserves, according to the Energy Information Administration (EIA). More than that Saudi Arabia is way out in front. The table below is in BILLIONS of barrels of oil. Countries in red are OPEC nations.

| 1 | Saudi Arabia | 264 |

| 2 | Canada | 178 |

| 3 | Iran | 132 |

| 4 | Iraq | 115 |

| 5 | Kuwait | 101 |

| 6 | United Arab Emirates | 97 |

| 7 | Venezuela | 79 |

| 8 | Russia | 60 |

| 9 | Libya | 39 |

| 10 | Nigeria | 35 |

| 11 | United States | 21 |

| 12 | China | 18 |

| 13 | Qatar | 15 |

| 14 | Mexico | 12 |

| 15 | Algeria | 11 |

| 16 | Brazil | 11 |

| 17 | Kazakhstan | 9 |

| 18 | Norway | 7 |

| 19 | Azerbaijan | 7 |

| 20 | India | 5 |

Top 20 countries: 1224.5 (95%)

OPEC can affect the cost of gasoline with even a threat of producing less oil. Doing so lowers (or causes the perception of lowering) supply relative to demand and therefore increases price. They don’t even actually have to do anything because the price is set by other groups which do not always behave rationally, but we will get to that.

Another word on OPEC, if you look at that list you will notice that none of those countries has what we would normally consider warm and friendly feelings towards the United States. It is pretty much a who’s who of who hates America. Interesting, since if we were not buying their product they would mostly be afterthoughts, or never-thought-abouts on the world stage.

Lastly with OPEC it is important to note that although they used to be able to push prices all over the place by increasing or limiting demand they have even less influence now than they have historically because with the exception of a couple of countries, Saudi Arabia for one, most of the member countries are pumping it out as fast as they can now despite what they agree to do. They are making money as fast as they can, while they can.

To get back on point you also have to understand a bit about the United States’ nearly insatiable need for Gasoline and other fuels. We are large geographically and we have by far and away the worlds’ largest economy (still). We use a LOT of oil. We use a lot of oil because we have decentralized our manufacturing plants away from Rail yards and have embraced Japan’s JIT (just in time) method of purchasing and logistics. This works well in a small country but in one as large as our it necessitates a tremendous amount of trucking.

Also because we average nearly three cars per household (even our so called poor drive) and because of the social and moral breakdown of our culture no one can stand to live in the city or town center and we all migrate as far away from there as possible we are more reliant on the automobile, because we all largely still work somewhere.

Couple that with the fact that we are more rural in nature than most of the other developed countries in the world to begin with AND the fact that we have grown up with the automobile instead of the automobile being a recent addition to a city that has been around since the middle ages (London, Paris, Rome, etc.) and you can see that our love affair with automobiles is not going anywhere.

One small but increasing factor is the rise in wealth of India and China. Their demand for oil is increasing because they are not riding bicycles as much as they used to. They want to drive cars. Incidentally this is forcing a lot of Americans to look towards riding a bicycle. But this is still not the reason gas is going up. And if everyone bought a Prius it would not really help.

Next let’s look at the Oil Companies themselves. We all hated that guy from BP and we have all heard how the Oil Companies are making record profits every quarter in the multiple Billions of Dollars. They are a fat and easy target. But you have to understand how their business works.

There is no such thing as an "Oil Company". It is an oversimplification for an entire industry made up of hundreds or maybe thousands of companies worldwide with different pieces of the overall oil business.

But for an oversimplification here is one possible option where the company does everything. The oil company will gain rights to the oil from the government, it leases or buys the land, drills the oil, ships it to a refinery, refines it, ships it to distributors, then gas stations, then sells it directly to the consumer.

The problem with this scenario is that no business does the whole thing alone. Many companies only do one stage in the process. Some major oil companies never get past transportation of the crude oil. Some only refine. Some only refine for certain products

They don’t set the price of the Crude Oil. Take Saudi Arabia for instance, Exxon or BP might have spent their money to find the oil in the seventies. They probably built the drill rigs and the pumping stations, but the OIL belongs to the King. Therefore he is in charge of when it gets pumped and when it doesn’t. And it works like that for all the other nations as well. Someone owns the mineral rights to the oil and someone else drills for it and hauls it. The ShelExxonBp’s of the world make contracts with the owners of the oil to develop their fields. That is why you hear talk to “leases” and such in the Gulf. In come cases the Government owns the land and controls who gets the leases and when an oil company’s lease runs out they move on or someone else moves in. Further complicating this is the fact that just because it says BP on the side of the oil rig, doesn’t mean it is really BP’s rig, these are often times outsourced to smaller companies working on contract. This is similar to an Airline, if you fly a lot you know it may say Delta on your ticket but you may be flying a local carrier (ComAir) leased to Delta. Or a trucking company where the driver is an owner/operator leased to a larger company.

Oil companies, the major ones at least, usually pump their own oil. They have exploitation permits (contracts) from the countries that they are pumping the oil from. In every contract the case is different. In some cases they pay a fixed amount up front to take the permit (contract) in other cases they pay a fixed amount per barrel they pump. The most usual case is that in the permit they agree to some very complicated formulas that determine the amount the companies pay to the countries for each barrel. In these cases they take under consideration the cost of pumping, oil prices, investments, number of barrels pumped etc.

It is important to note they may do this YEARS in advance. So oil companies are making huge profits now because prices are up now and they agreed to contracts speculating what the overhead costs and the price of a barrel of oil would be years ago. All you have to do is look at the price of gas for the past decade to see that no one would have figured that kind of rise into a forward looking contract.

They invested in oil fields when prices were much lower, with the expectation that they could break even at, say, $50 per barrel. Since the market price is now more than $100 a barrel, the extra money is gravy. It's like a farmer who can raise corn for $1.50 a bushel. If the market price is $1.75, he makes a quarter per bushel. If the market price jumps to $2.25, his profits jump as well. (If the market crashes to $1 per bushel, the farmer loses money. That can happen to oil companies as well.) Oil companies, like the farmer, are the beneficiaries of high market prices, but they can no more control those prices than a farmer can dictate what he gets for a bushel of corn.

This may seem strange to many readers who did not grow up in a farming or mining or oil producing area. But when you are a farmer you don’t know what your profit will be at the end of the harvest because you don’t know what your beans or corn will be selling for. Again, not to get ahead of myself but this is the way it works. You are a farmer and you make a decision to raise beans. Typically you borrow the money to put your crop in, for seeds, fuel, labor the whole shebang. You know when it comes harvest time where you will be taking your beans. There are only a few buyers in any area. If you are lucky you can get a contract for X amount of dollars per bushel when you plant. This is a simple form of a “future” When you hear on the news that “Corn futures are trading up $.02” that is what they are talking about. People buys and sell contracts on prices for all kinds of things as if it were stock in a company on the “Commodity Market”. These people are “Speculators.” It gets really complicated really quick trying to make sense of all the rules and strategy of the game. There are buyers and sellers and then their are third party brokers just making money in the transaction or the trading of the contracts themselves. Basically think of “futures” as insurance against taking a severe beating at the end of the harvest, or you may buy an “Option” which is even better, you have the “Option” of selling it for this price unless you don’t want to, in which case you don’t have to. You may contract all your crop for one price or break it up or only put part of it in contract and play the wait-and-see-game with the rest. Then again you might lose the crop or not raise as much as you thought and that is bad. That is how banks get farms cheap.

But who sets the market Price? It must be the Gas Station Owners right? Well to some extent, yes, but not completely.

It goes something like this, every day a station gets emailed the wholesale cost for a gallon of gas, for reference. They use that number and then add other costs in to try to figure out what their ideal price point would be. . At most convenience stores the gas is what brings in the customers but snack sales are what keeps the lights on.

But the reality of what consumers pay at the pump has little to do with the literal cost of the gas in the tanks at the store.Here's an approximation of where each dollar you spend on gas goes:

- Crude oil: 55 cents

- Refining: 14 cents

- Distribution and Marketing: 8 cents

- Taxes: 13 cents

You know the hidden number in a gallon of gas? You know, we say that gas is 3.85 but there is that other little number that is not rounded up. gas is really 3.859. . That is usually the profit margin of the store itself on gas.

Back to the cost of gasoline: oil is traded just like any other commodity, by the use of Futures and Options. Both of them are financial products. Here is a generalization on how this might work. Lets say that you want to buy a barrel of oil, not right now, but in six months. You believe that in six months the barrel will cost $60 . Then you buy a future that is worth $60. In six months you go to the market to buy your barrel. If the barrel costs more than $60 you use your future and take it at that price. If it costs less you do not use your future and buy it normally. Do not take all these literally, the way futures and options work is far more complex and they are also subject to supply and demand.

Another thing that might put this in perspective is the difference you pay for ticket prices to a concert or sporting event. You can pre-purchase them cheaper than you can at the door. Now think about if you didn’t know for sure but there was a possibility that the tickets at the door might go on SALE just before showtime and also a possibility that they could go way way up . You pre-purchased ticket is a hedge against a higher price, a “Future”.

Please note that oil is not bought only by Oil companies but also countries who further complicate the process.

When the spot value, or the value “right now” goes up usually the future and options values go up. That means that when the prices increases the companies anticipate that in the future when they will need to buy more futures to buy more oil they will have to pay more money. What they do is they sell the oil they already have at a higher price to find the money to buy the new options and futures.

You can understand now why when the spot prices go up you have an immediate increase on the gas at the gas station. They will sell gas at higher prices even though they use reserves that they bought much cheaper in order to compensate for the future prices they will have to pay.

One more reason for the immediate rises at the gas-stations is the fact that the gas-station owners and gas distributors do take advantage of the situation. When all the media say that the prices go higher they find it a great opportunity to take advantage and make more money. They do this because they can, there is literally no law against it.

Please also note that the taxes on fuels, is oftentimes a percentage of its value. So the higher the price the more taxes you pay. Finally the supply chain of oil is complicated and a lot of different companies take part in it. All of them have a specific margin that they calculate it on the price they bought the oil. The gas that you buy at the pump is much more expensive than the oil that it is pumped at the well.

So, if the price is not set by OPEC, and not by ShelExxonBP, and not by the local corner station, who really slaps the price per barrel on the barrel of oil?

The Government? No. Now, the government can influence things for reasons we will get into in just a bit. Without getting off topic; opponents of increased domestic drilling say it will not affect immediate gas prices. This is patently illogical because just like with OPEC, the threat of increased supply will lower prices immediately. The other thing that always gets glossed over is that increasing our domestic drilling probably would not lower worldwide oil prices, but it could lower our domestic gas prices. to deny that is ludicrous int eh extreme, for one thing we would not be paying for shipping oil halfway around the world. Our refinieries are in the gulf. not coincidentally a lot of our vacant oil fields are within several hundred miles of the gulf coast. The withholding of permits for drilling at home and the idling of our ancient refineries (none new since ‘76 because the government will not allow it) has a definite deleterious impact on what we pay at the pump, to think otherwise is insanity. But the government doesn’t set gas prices. Oh, and opening up the strategic reserves is about like a fireman using a bottle of Evian to put out a fire. Sure it is water, but it ain’t near enough. The strategic reserves are to allow the military and necessary infrastructure of the country to survive a short term embargo or military operation. Not to make it affordable for you to take the ‘lade to starbucks. It is a mere fraction of what the public uses in a very short amount of time.

Ok, so gas prices are not completely at the whim of Government either. So WHO controls the price of Oil?

The guy we haven’t really talked about much. Not the Producer, and not the Consumer, the other guy. The guy in the system who doesn’t care whether it is oil or corn or sow bellies. The guy who makes his money trading “futures”. These folks buy futures and sell and trade them to make money in the middle of the process between producer and consumer. The so called “speculator”. Remember Enron? That was one of their gigs. But lots of other companies do it too, you can buy futures online. They might be part of your mutual fund or 401k. And the Futures on Oil are traded on the NYMEX.

NYMEX is a Commodity exchange. Commodity exchanges began in the middle of the 19th century, when businessmen began organizing market forums to make buying and selling of commodities easier. These marketplaces provided a place for buyers and sellers to set the quality, standards, and establish rules of business. By the late 19th century about 1,600 marketplaces had sprung up at ports and railroad stations. In 1872, a group of Manhattan dairy merchants got together and created the Butter and Cheese Exchange of New York. Soon, egg trade became part of the business conducted on the exchange and the name was modified to the Butter, Cheese, and Egg Exchange. In 1882, the name finally changed to the New York Mercantile Exchange when opening trade to dried fruits, canned goods, and poultry.

As centralized warehouses were built into principal market centers such as New York and Chicago in the early 20th century, exchanges in smaller cities began to disappear giving more business to the exchanges such as the NYMEX in bigger cities. Now, the NYMEX operates in a trading facility and office building with two trading floors in the World Financial Center in downtown Manhattan

The floor of the NYMEX is regulated by the Commodity Futures Trading Commission, an independent agency of the United States government. Each individual company that trades on the exchange must send its own independent brokers. Therefore, a few employees on the floor of the exchange represent a big corporation and the actual employees of the MYMEX only record the transactions and have nothing to do with the actual trade. The NYMEX is one of the few exchanges in the world to maintain the open outcry system, where traders employ shouting and complex hand gestures on the physical trading floor.

Yes that is right, the cost of a barrel of oil is ultimately decided by a few people yelling and waving hand signs at each other in New York.

These traders are the ones ultimately responsible for the cost of a barrel of crude. They don’t represent Oil Companies, at least not directly, they represent Hedge Funds and Brokerage houses.

Now, I am

not economist, there are many many people who could lose me instantly in a discussion on this topic. But I am smart enough to know that there are groups and people in this scenario with enough pull to influence the market. Some of them may be big oil executives, some might be foreign governments, but by and large it is just like the stock market. It cannot really be controlled, but it can be nudged, and we know who likes to nudge everything.

-KOOK

May 02, 2011

Osama Is Dead - Random Thoughts

I know that this is not cause for celebration. When you put down a rabid animal, it is a job that needs done, and you do it without regret, but you should not be exultant about it.

Justice has been done, it was grim business, it was done, and now we should just move on. You don't celebrate. (nevermind when it actually happened)

The pictures on the web and on facebook with the Statue of Liberty holding Osama's head sicken me.

Then again, the fact that we have not been shown any good proof and that he was buried at sea leaves me feeling empty.

Sad too, that I am so cynical and disgusted with the government, and this pResident, that I find it awfully coincedental that they ANNOUNCE this during an election year when there is very little for Obama to crow about. Gas is high, we are still in Iraq and Afghanistan, and now he put us in Libya as well. Unemployment is still at a 30 year high. He has failed to deliver on many of the promises he made to get elected (promises that I was mostly against anyway). All of this is causing him trouble with his base. And I know how all of us feel about him.

I am old enough that I don't believe in coincidences much anymore. So I will dust off my tin foil hat and wonder if it is possible that Osama died when I thought he did and the (wise) decision was made (by the previous administration) to keep it quiet to prevent martyrdom and retaliation. But I hate being a conspiracy theorist all the time. So I don't know what to think..

It just leaves me with a nagging thought that we will never truly know now for sure who was killed in Pak-e-Stahn. .

If nothing else, the result is the same in my humblest of opinions.

1. Obama gets to make political hay out of this when the work was done by others

2. Now there is a real rallying cry for all the would-be terrorists out there

3. All the jubilant announcing of Osama's death will do is decrease our safety.

Just my thoughts, what are yours?