Right now gas prices are hovering around the $3.80 mark in my area of the country. We have all heard rumors of the so far mythical $5 a gallon gas in the US. This is obviously a source of much angst in the US because we are a large country with a large suburban and rural population who have literally grown up as a nation with the automobile. What is more we like BIG automobiles because we spend a lot of time. We like big automobiles because we have active lifestyles, and we use them to work, and we like to feel safe.

So who is to blame? Is it those filthy Oil Executives? OPEC? The owner of the convenience store chain? The government? Yes. it is all of those folks. But it is way more complicated than that and unfortunately even after a lot of study the answers are not that satisfying. What is more it is so complicated that there is no easy answer.

To even begin to understand this issue you have to start at the beginning. It is the most basic Economic rule. Supply and Demand. On the Supply side is a group of countries, primarily known as OPEC, Oil Producing and Exporting Countries.

OPEC is a consortium of 13 countries: Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela. Together, these 13 nations are responsible for 40 percent of the world's oil production and hold the majority of the world's oil reserves, according to the Energy Information Administration (EIA). More than that Saudi Arabia is way out in front. The table below is in BILLIONS of barrels of oil. Countries in red are OPEC nations.

| 1 | Saudi Arabia | 264 |

| 2 | Canada | 178 |

| 3 | Iran | 132 |

| 4 | Iraq | 115 |

| 5 | Kuwait | 101 |

| 6 | United Arab Emirates | 97 |

| 7 | Venezuela | 79 |

| 8 | Russia | 60 |

| 9 | Libya | 39 |

| 10 | Nigeria | 35 |

| 11 | United States | 21 |

| 12 | China | 18 |

| 13 | Qatar | 15 |

| 14 | Mexico | 12 |

| 15 | Algeria | 11 |

| 16 | Brazil | 11 |

| 17 | Kazakhstan | 9 |

| 18 | Norway | 7 |

| 19 | Azerbaijan | 7 |

| 20 | India | 5 |

Top 20 countries: 1224.5 (95%)

OPEC can affect the cost of gasoline with even a threat of producing less oil. Doing so lowers (or causes the perception of lowering) supply relative to demand and therefore increases price. They don’t even actually have to do anything because the price is set by other groups which do not always behave rationally, but we will get to that.

Another word on OPEC, if you look at that list you will notice that none of those countries has what we would normally consider warm and friendly feelings towards the United States. It is pretty much a who’s who of who hates America. Interesting, since if we were not buying their product they would mostly be afterthoughts, or never-thought-abouts on the world stage.

Lastly with OPEC it is important to note that although they used to be able to push prices all over the place by increasing or limiting demand they have even less influence now than they have historically because with the exception of a couple of countries, Saudi Arabia for one, most of the member countries are pumping it out as fast as they can now despite what they agree to do. They are making money as fast as they can, while they can.

To get back on point you also have to understand a bit about the United States’ nearly insatiable need for Gasoline and other fuels. We are large geographically and we have by far and away the worlds’ largest economy (still). We use a LOT of oil. We use a lot of oil because we have decentralized our manufacturing plants away from Rail yards and have embraced Japan’s JIT (just in time) method of purchasing and logistics. This works well in a small country but in one as large as our it necessitates a tremendous amount of trucking.

Also because we average nearly three cars per household (even our so called poor drive) and because of the social and moral breakdown of our culture no one can stand to live in the city or town center and we all migrate as far away from there as possible we are more reliant on the automobile, because we all largely still work somewhere.

Couple that with the fact that we are more rural in nature than most of the other developed countries in the world to begin with AND the fact that we have grown up with the automobile instead of the automobile being a recent addition to a city that has been around since the middle ages (London, Paris, Rome, etc.) and you can see that our love affair with automobiles is not going anywhere.

One small but increasing factor is the rise in wealth of India and China. Their demand for oil is increasing because they are not riding bicycles as much as they used to. They want to drive cars. Incidentally this is forcing a lot of Americans to look towards riding a bicycle. But this is still not the reason gas is going up. And if everyone bought a Prius it would not really help.

Next let’s look at the Oil Companies themselves. We all hated that guy from BP and we have all heard how the Oil Companies are making record profits every quarter in the multiple Billions of Dollars. They are a fat and easy target. But you have to understand how their business works.

There is no such thing as an "Oil Company". It is an oversimplification for an entire industry made up of hundreds or maybe thousands of companies worldwide with different pieces of the overall oil business.

But for an oversimplification here is one possible option where the company does everything. The oil company will gain rights to the oil from the government, it leases or buys the land, drills the oil, ships it to a refinery, refines it, ships it to distributors, then gas stations, then sells it directly to the consumer.

The problem with this scenario is that no business does the whole thing alone. Many companies only do one stage in the process. Some major oil companies never get past transportation of the crude oil. Some only refine. Some only refine for certain products

They don’t set the price of the Crude Oil. Take Saudi Arabia for instance, Exxon or BP might have spent their money to find the oil in the seventies. They probably built the drill rigs and the pumping stations, but the OIL belongs to the King. Therefore he is in charge of when it gets pumped and when it doesn’t. And it works like that for all the other nations as well. Someone owns the mineral rights to the oil and someone else drills for it and hauls it. The ShelExxonBp’s of the world make contracts with the owners of the oil to develop their fields. That is why you hear talk to “leases” and such in the Gulf. In come cases the Government owns the land and controls who gets the leases and when an oil company’s lease runs out they move on or someone else moves in. Further complicating this is the fact that just because it says BP on the side of the oil rig, doesn’t mean it is really BP’s rig, these are often times outsourced to smaller companies working on contract. This is similar to an Airline, if you fly a lot you know it may say Delta on your ticket but you may be flying a local carrier (ComAir) leased to Delta. Or a trucking company where the driver is an owner/operator leased to a larger company.

Oil companies, the major ones at least, usually pump their own oil. They have exploitation permits (contracts) from the countries that they are pumping the oil from. In every contract the case is different. In some cases they pay a fixed amount up front to take the permit (contract) in other cases they pay a fixed amount per barrel they pump. The most usual case is that in the permit they agree to some very complicated formulas that determine the amount the companies pay to the countries for each barrel. In these cases they take under consideration the cost of pumping, oil prices, investments, number of barrels pumped etc.

It is important to note they may do this YEARS in advance. So oil companies are making huge profits now because prices are up now and they agreed to contracts speculating what the overhead costs and the price of a barrel of oil would be years ago. All you have to do is look at the price of gas for the past decade to see that no one would have figured that kind of rise into a forward looking contract.

They invested in oil fields when prices were much lower, with the expectation that they could break even at, say, $50 per barrel. Since the market price is now more than $100 a barrel, the extra money is gravy. It's like a farmer who can raise corn for $1.50 a bushel. If the market price is $1.75, he makes a quarter per bushel. If the market price jumps to $2.25, his profits jump as well. (If the market crashes to $1 per bushel, the farmer loses money. That can happen to oil companies as well.) Oil companies, like the farmer, are the beneficiaries of high market prices, but they can no more control those prices than a farmer can dictate what he gets for a bushel of corn.

This may seem strange to many readers who did not grow up in a farming or mining or oil producing area. But when you are a farmer you don’t know what your profit will be at the end of the harvest because you don’t know what your beans or corn will be selling for. Again, not to get ahead of myself but this is the way it works. You are a farmer and you make a decision to raise beans. Typically you borrow the money to put your crop in, for seeds, fuel, labor the whole shebang. You know when it comes harvest time where you will be taking your beans. There are only a few buyers in any area. If you are lucky you can get a contract for X amount of dollars per bushel when you plant. This is a simple form of a “future” When you hear on the news that “Corn futures are trading up $.02” that is what they are talking about. People buys and sell contracts on prices for all kinds of things as if it were stock in a company on the “Commodity Market”. These people are “Speculators.” It gets really complicated really quick trying to make sense of all the rules and strategy of the game. There are buyers and sellers and then their are third party brokers just making money in the transaction or the trading of the contracts themselves. Basically think of “futures” as insurance against taking a severe beating at the end of the harvest, or you may buy an “Option” which is even better, you have the “Option” of selling it for this price unless you don’t want to, in which case you don’t have to. You may contract all your crop for one price or break it up or only put part of it in contract and play the wait-and-see-game with the rest. Then again you might lose the crop or not raise as much as you thought and that is bad. That is how banks get farms cheap.

But who sets the market Price? It must be the Gas Station Owners right? Well to some extent, yes, but not completely.

It goes something like this, every day a station gets emailed the wholesale cost for a gallon of gas, for reference. They use that number and then add other costs in to try to figure out what their ideal price point would be. . At most convenience stores the gas is what brings in the customers but snack sales are what keeps the lights on.

But the reality of what consumers pay at the pump has little to do with the literal cost of the gas in the tanks at the store.Here's an approximation of where each dollar you spend on gas goes:

- Crude oil: 55 cents

- Refining: 14 cents

- Distribution and Marketing: 8 cents

- Taxes: 13 cents

You know the hidden number in a gallon of gas? You know, we say that gas is 3.85 but there is that other little number that is not rounded up. gas is really 3.859. . That is usually the profit margin of the store itself on gas.

Back to the cost of gasoline: oil is traded just like any other commodity, by the use of Futures and Options. Both of them are financial products. Here is a generalization on how this might work. Lets say that you want to buy a barrel of oil, not right now, but in six months. You believe that in six months the barrel will cost $60 . Then you buy a future that is worth $60. In six months you go to the market to buy your barrel. If the barrel costs more than $60 you use your future and take it at that price. If it costs less you do not use your future and buy it normally. Do not take all these literally, the way futures and options work is far more complex and they are also subject to supply and demand.

Another thing that might put this in perspective is the difference you pay for ticket prices to a concert or sporting event. You can pre-purchase them cheaper than you can at the door. Now think about if you didn’t know for sure but there was a possibility that the tickets at the door might go on SALE just before showtime and also a possibility that they could go way way up . You pre-purchased ticket is a hedge against a higher price, a “Future”.

Please note that oil is not bought only by Oil companies but also countries who further complicate the process.

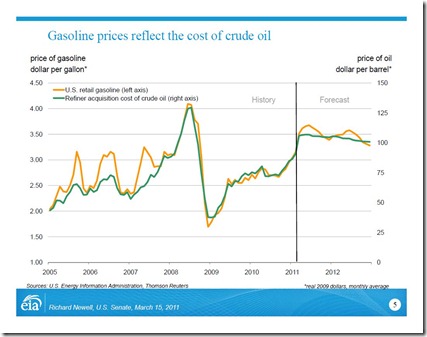

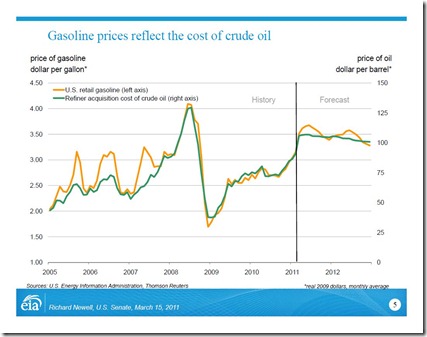

When the spot value, or the value “right now” goes up usually the future and options values go up. That means that when the prices increases the companies anticipate that in the future when they will need to buy more futures to buy more oil they will have to pay more money. What they do is they sell the oil they already have at a higher price to find the money to buy the new options and futures.

You can understand now why when the spot prices go up you have an immediate increase on the gas at the gas station. They will sell gas at higher prices even though they use reserves that they bought much cheaper in order to compensate for the future prices they will have to pay.

One more reason for the immediate rises at the gas-stations is the fact that the gas-station owners and gas distributors do take advantage of the situation. When all the media say that the prices go higher they find it a great opportunity to take advantage and make more money. They do this because they can, there is literally no law against it.

Please also note that the taxes on fuels, is oftentimes a percentage of its value. So the higher the price the more taxes you pay. Finally the supply chain of oil is complicated and a lot of different companies take part in it. All of them have a specific margin that they calculate it on the price they bought the oil. The gas that you buy at the pump is much more expensive than the oil that it is pumped at the well.

So, if the price is not set by OPEC, and not by ShelExxonBP, and not by the local corner station, who really slaps the price per barrel on the barrel of oil?

The Government? No. Now, the government can influence things for reasons we will get into in just a bit. Without getting off topic; opponents of increased domestic drilling say it will not affect immediate gas prices. This is patently illogical because just like with OPEC, the threat of increased supply will lower prices immediately. The other thing that always gets glossed over is that increasing our domestic drilling probably would not lower worldwide oil prices, but it could lower our domestic gas prices. to deny that is ludicrous int eh extreme, for one thing we would not be paying for shipping oil halfway around the world. Our refinieries are in the gulf. not coincidentally a lot of our vacant oil fields are within several hundred miles of the gulf coast. The withholding of permits for drilling at home and the idling of our ancient refineries (none new since ‘76 because the government will not allow it) has a definite deleterious impact on what we pay at the pump, to think otherwise is insanity. But the government doesn’t set gas prices. Oh, and opening up the strategic reserves is about like a fireman using a bottle of Evian to put out a fire. Sure it is water, but it ain’t near enough. The strategic reserves are to allow the military and necessary infrastructure of the country to survive a short term embargo or military operation. Not to make it affordable for you to take the ‘lade to starbucks. It is a mere fraction of what the public uses in a very short amount of time.

Ok, so gas prices are not completely at the whim of Government either. So WHO controls the price of Oil?

The guy we haven’t really talked about much. Not the Producer, and not the Consumer, the other guy. The guy in the system who doesn’t care whether it is oil or corn or sow bellies. The guy who makes his money trading “futures”. These folks buy futures and sell and trade them to make money in the middle of the process between producer and consumer. The so called “speculator”. Remember Enron? That was one of their gigs. But lots of other companies do it too, you can buy futures online. They might be part of your mutual fund or 401k. And the Futures on Oil are traded on the NYMEX.

NYMEX is a Commodity exchange. Commodity exchanges began in the middle of the 19th century, when businessmen began organizing market forums to make buying and selling of commodities easier. These marketplaces provided a place for buyers and sellers to set the quality, standards, and establish rules of business. By the late 19th century about 1,600 marketplaces had sprung up at ports and railroad stations. In 1872, a group of Manhattan dairy merchants got together and created the Butter and Cheese Exchange of New York. Soon, egg trade became part of the business conducted on the exchange and the name was modified to the Butter, Cheese, and Egg Exchange. In 1882, the name finally changed to the New York Mercantile Exchange when opening trade to dried fruits, canned goods, and poultry.

As centralized warehouses were built into principal market centers such as New York and Chicago in the early 20th century, exchanges in smaller cities began to disappear giving more business to the exchanges such as the NYMEX in bigger cities. Now, the NYMEX operates in a trading facility and office building with two trading floors in the World Financial Center in downtown Manhattan

The floor of the NYMEX is regulated by the Commodity Futures Trading Commission, an independent agency of the United States government. Each individual company that trades on the exchange must send its own independent brokers. Therefore, a few employees on the floor of the exchange represent a big corporation and the actual employees of the MYMEX only record the transactions and have nothing to do with the actual trade. The NYMEX is one of the few exchanges in the world to maintain the open outcry system, where traders employ shouting and complex hand gestures on the physical trading floor.

Yes that is right, the cost of a barrel of oil is ultimately decided by a few people yelling and waving hand signs at each other in New York.

These traders are the ones ultimately responsible for the cost of a barrel of crude. They don’t represent Oil Companies, at least not directly, they represent Hedge Funds and Brokerage houses.

Now, I am

not economist, there are many many people who could lose me instantly in a discussion on this topic. But I am smart enough to know that there are groups and people in this scenario with enough pull to influence the market. Some of them may be big oil executives, some might be foreign governments, but by and large it is just like the stock market. It cannot really be controlled, but it can be nudged, and we know who likes to nudge everything.

-KOOK